Treasury Inflation Protected Securities (TIPS) have the properties of a bond. Since bonds are just a kind of loan, we can expect to get our money back when the loan period is over. What makes TIPS especially attractive, however, is that the principal value is adjusted for inflation over time. This eliminates a bond’s worst enemy. This valuable feature does have a drawback, though. There’s more complexity in determining what the value of a TIPS bond is. Not only are there two ways to consider the value as I discuss in the article: Two Ways to Look at TIPS, the value of the principal is constantly changing.

If you’re a saver like me, you are probably interested in the current value of the principal of your TIPS. In order to determine that, we need to adjust the bond’s face value by all of the inflation that has been experienced up to now.

Adjusted Principal

The adjusted principal of a TIPS is the amount of money that you would receive if the bond were due today. You can’t get that money today, but it is the what it would be worth if it were due. For those of us with a strategy to hold the bond until maturity, this is a meaningful number. It gives us a view into how much inflation we have been protected from so far. It is also the number that indicates how much interest you will get on the next coupon. If our coupon (interest) rate is 1%, that 1% is not calculated on the face value of the bond, but on the adjusted principal. That means that your interest is going up with inflation too.

Three Step Overview

It’s actually pretty easy to calculate your TIPS current value. The basic procedure is this:

- Get the CUSIP of your TIPS

- Go to TreasuryDirect and look up today’s inflation “index ratio” for your specific TIPS.

- Multiply the index ratio by the face value of your TIPS.

That’s really all you have to do. If you hold several different TIPS with different CUSIP numbers, you will need to repeat this process for all of your CUSIP’s.

TIPS CUSIP’s

Every bond that is tracked by the public market has a special identifier called a CUSIP. There are thousands and thousands of these but they each identify a single bond issue. When you purchase a TIPS at your brokerage or online you will see your CUSIP for the bond on you “trade confirmation.” For this example we are going to use the current 10 year TIPS CUSIP and that is: 9128283R9. This bond was originally issued on 1/18/2018.

Finding your TIPS Index Ratio

The index ratio for a TIPS is a number that you multiply with the face value of your TIPS in order to determine it’s current real value. TreasuryDirect keeps track of all of these numbers for every TIPS that is currently available on the market. Every day there is a new index ratio for every bond. You can look up the index ratios for your TIPS by going to this page on TreasuryDirect:

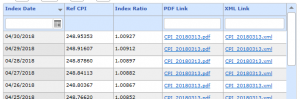

When you open this page, you will see all of the CUSIP’s listed for every TIPS that hasn’t matured yet. Then, you click on your CUSIP number. When I click on the number 9128283R9, I get a list dates along with some other numbers in a table. For the sake of my example, lets say that it is April 28th. To get the Index Ratio, I would go down the list to 4/28/2018 and then go over to the Index Ratio column and see the number: 1.00897. You will need to get this number for every TIPS that hold.

Calculating the Adjusted TIPS Value

The last step is easy. For each one of your TIPS that you now have an Index Ratio for, you just take the total face value and multiply it by the Index Ratio. That is your adjusted principal value.

For my example, let’s say that I have two TIPS bonds with the CUSIP 9128283R9 with an original face value of $1000. My total face value for both is $2000. Then multiply that by the Index Ratio I looked up: $2000 x 1.00897. The resulting current value is: $2,017.94. This tells me that my money is currently being protected from $17.94 of inflation.

If I had quite a few different TIPS with many different CUSIP’s, this might take a little while to do. You can make it go a bit faster by getting my free TIPS Tracker Spreadsheet. I hope to make this process much faster when the new software is released.

So, that’s how you do it. It’s pretty neat to see your money go up in value, especially on days when the stock market is down. I urge you to give it a try and experience it for yourself.