Our unbacked U.S dollar has been used to create a corrupt financial system. It’s important for moral people to not participate in something that is known to be corrupt as much as possible. Although some use of the dollar may be unavoidable, the good news is that there are ways that we can choose to avoid it.

Gold and silver coins were intended to be the money of the United States. It is possible to use gold and silver as money instead of using paper notes that aren’t redeemable for anything. In this article I explain the problem and propose one good solution. I’m going to explain how you can get your own gold and silver account with the UPMA and why it makes sense.

This isn’t just a way to invest in gold and silver. It’s a way to start using it for everyday purchases and to make investments, which is what I believe will help to bring healing back to our broken monetary system.

There are many important reasons for getting out of the paper currency system:

- The paper dollar loses value by government policy which destroys savings

- Giving a group of people the ability to print money at will, encourages corruption

- The Constitution of the United States says we are supposed to be using gold and silver

- Using gold and silver as money makes it much harder to deny access to your money

- Using physical gold and silver is more private because no one else has to know about your transactions.

- You could be earning inflation protected interest by leasing out a gold balance to a business.

Only about 50 years ago, most banks used to store and lend money as gold and silver. The government quit backing paper dollars with gold in any way by not allowing anyone to exchange them for a specific amount of gold.

The reality is, we don’t need anyone’s permission to start doing what we know is right. We can start using gold and silver with each other now. This puts our own finances back on a gold standard. You could open a gold and silver account today. I’d like to show you one good way to do that here.

The United Precious Metals Association (UPMA) provides a way that you can cost-effectively store your money in gold and silver coins. It is an online service that gives you three kinds of accounts: a U.S Silver Dollar account, a U.S. Gold Dollar account and a Goldback account, which are real gold bills you can use as cash. The service allows you to pay for things directly to other account holders too. This means that you can do digital transactions in gold and sliver online which removes the inconvenience of delivering physical metal.

By opening a gold and silver account at the UPMA, you protect your money from inflation, inappropriate taxation and from the control of the corrupt banking system. Another great feature is that you can even earn interest on your gold and silver if you choose to do that with a portion of your savings.

These accounts are serviced by a gold and silver depository called Alpine Gold Exchange and are:

- Easy to use online,

- 100% insured,

- Available to both individuals and business entities.

- There is no cost to sign up,

- No commitment to making or investments required,

- No minimum balance required.

The existing corrupt financial system steals money secretly through inflation. By making money easier to borrow, governments revalue their currency by increasing the amount that is loaned into existence. This video explains more about inflation and how UPMA accounts help protect us:

The UPMA is not just a another place to store your investments in gold. It’s a completely different concept. It’s organized as a non-profit organization. It’s an association of members that has the feel of a credit union that exists for its members.

Understanding the “Spread”

Did you know that most gold dealers don’t post the same prices for buying and selling? What you usually see is the price you will have to pay, not the price they would pay you (which is much lower!) The UPMA is very different. They don’t sell the gold to you at one price and then only take the gold back at a lower price. This practice is called the buy/sell spread. UPMA members always get the posted rates for both buying and selling, unless you sell more that $10,000 in a month. This is something that makes the UPMA very unique. Here’s more about that:

Considering Storage Options

I personally believe it is important to keep some of the actual metal at home. If we use it in place of cash, then you need to have some actual metal to use to pay for things. One of the problems, though, is that having a lot of cash at home, starts to become a risk. Wouldn’t it be nice to also have a place to store larger amounts that is protected from flood, fire and is both audited and insured?

The UPMA holds your money physically in gold or silver in its high-security professional storage facility. They take physical records and maintain those outside of a computer as well. Splitting your metal holdings between what you have at home and what you store in a professional facility really makes sense when you think about it.

What Using U.S. Coins Means for Taxes

The UPMA holds your gold and silver in U.S. silver and gold coins with an option to store in Goldbacks as well. This means that you are buying and selling using money not barter. It also means that you shouldn’t have to pay taxes just for spending your gold or silver money to buy things.

Unfortunately, the federal government’s enforcement doesn’t match the law. Much will have to be done by our states to hold both state and federal officials to the law and remove those who don’t.

Because of the illegal activity by government agencies and states, I still recommend that you keep track of your purchases and sales of U.S. gold and silver coins for tax purposes, unless you have a sheriff and a state that will defend you against government theft.

Pawning (Loaning Gold to Yourself)

When you use U.S. gold and silver coins to make purchases, you should not be required to pay capital gains taxes. Taxing authorities appear to be requiring that conversions from gold to paper dollars be reported on tax forms. If they decide not to recognize the transaction as a legal tender but instead as barter, the move from metal to paper might trigger the government to wrongfully assert that you must pay capital gains tax.

For this reason, the UPMA is also offering a pawn service option. It’s like loaning your gold to yourself. It does have a cost, because you must pay a pawn broker to manage the loan until you “pay yourself back” what you borrow from your account. But since you borrowed to get cash, there was no capital gain. Even though this shouldn’t be a tax consideration, it is another service provided to UPMA members to make sure that there isn’t any wrongful government interference.

So there is a safe way to store large amounts of gold.

It’s important to understand the costs too. Since gold and silver are real things, they must be stored by someone and that does have a cost. This is one way that Alpine Gold gets paid.

Storage Fees

The storage fees are .05% every month paid for in gold and silver. So, 1 ounce of gold costs .05 ounces a month. If gold was valued at $3000 per ounce, that would be $1.50 per month.

This is an important consideration, but I might add that it isn’t uncommon for the value of gold to go up more than 10% in a single year these days. Often it has been much higher than that. Paying $1.50 per month is $18 a year which is only 0.6%. The benefits clearly out-weigh the cost.

If you have invested your savings before, you know that there isn’t any investment that doesn’t have a fee (even if it is well hidden). These fees are low and clearly stated.

If you choose to hold only Goldbacks, there currently is no storage fee. More about Goldbacks later.

But there’s another very important thing you could do to avoid paying storage fees.

Getting Inflation Protected Interest

You could get paid for leasing out some of your gold. When you do that, you are not charged storage fees, and you get paid 2% in gold.

Leasing your coins is very much like having a one year “certificate of deposit” at a bank only you retain custody. It allows you to lend your money for a fixed period of time. The thing that really makes a difference is that the interest is also in gold or silver coin. This means that your investment is naturally protected from inflation. Even the interest is. That’s something that is nearly impossible to find in our paper money economy.

Leased gold is used to fund businesses. Usually, these businesses are the kind that have to keep an inventory of gold or silver in order to operate. Some of them actually mine which gives them gold or silver as a product of their business. When these businesses borrow in gold, it makes it easier for them to manage and tends to make the risk cheaper to insure.

One type of business that uses these leases to fund business is the manufacturer the makes the “Goldback”.

Golden Cash

That brings me to one of the newest local money alternatives that is also provided by the UPMA. A Goldback is a real gold monetary unit. It’s in the shape of a bill. Each one contains 1/1000 of an ounce of gold. The UPMA allows you to purchase these as well and store them in an account or have them delivered to you whenever you wish to withdrawal them.

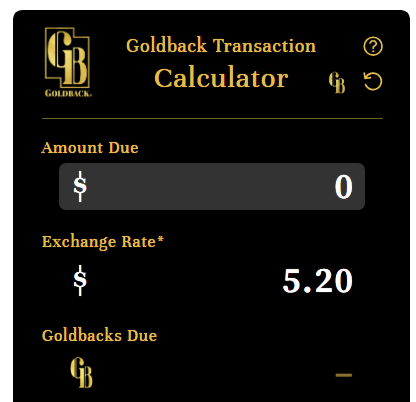

Individuals and businesses can easily accept Goldbacks as payment. There’s even a calculator that keeps track of the average daily price. It helps you calculate the paper dollar exchange rate.

You don’t need to sign up for the UPMA or do anything to start accepting Goldbacks. They are private and a great replacement for paper cash.

Several states have decided to offer their citizens the ability to use precious metal-delimited instruments, also called specie, as legal tender in the state. This give the people of those states the ability to use gold and silver as money when they buy things there.

One of the difficulties with buying and selling with metal is that silver is heavy and gold is so valuable that you have to have very tiny coins in order to use it for every-day buying and selling.

The Goldback is a high-tech alternative to coined money. They are bills that use a modern process to put gold inside a plastic coating in very specific quantities. It’s a revolutionary new way to have and use cash.

There’s even a cartoon that teaches kinds the benefits of using real money. I found this Tuttle Twins episode to be helpful for big kids too. Now even a kid can own gold!

Legit and Fraud Protected

They are produced with technology that creates articulate designs and fraud protection making them very hard to fake. You can learn more about a third-party verification of the Goldback’s quality here.

The UPMA allows you to hold Goldbacks in your UPMA account without paying for vaulting fees at all. You can withdrawal Goldbacks from your account and have them sent to you at any time.

Getting Gold into Your Own Hands

The UPMA is holding your gold and silver but if you want, they will ship it out to you. Not only that, there are now gold ATMs cropping up around the United States. Check this out:

There are also an increasing number of businesses that are willing to exchange their goods and services for Goldbacks. There are even state government officials getting involved.

Some Notable Opinions

One of the most revealing and popular books about the fiat money system: “The Creature from Jekyll Island: A Second Look at the Federal Reserve”, was written many years ago by G. Edward Griffin. As a self-proclaimed critic of things like this, here’s what he has to say:

In this article and video, Alpine Gold and Mr. Griffin discuss the UPMA, addressing concerns and benefits.

Something More Important than Money

Having an honest money system is important, but what is more important than anything is being prepared for what happens after this life is over. It wouldn’t do any good for me to show you a way to preserve the value of your money and just let you die and and discover that God had expectations that you have failed to live up to.

This is the most important thing that I have to share because it deals with true wealth that happens after this life is over.

Please download my free PDF of the gospel of John and read it carefully. That will pay me more than anything.

If you are interested in getting a UPMA account, using my referral link to sign up will help me. This gives me a very small portion of your vaulting fees (up to a limit) which rewards me for telling you about the UPMA.

Sign Up Here

To join the UPMA you can use my link to sign up and it will help me. The sign up process is surprisingly easy! Just tap or click on UPMA below

Bonds are one of the easiest and most common ways to save money for the long term. There’s a good chance you already own one. If you have a certificate of deposit at your bank or your credit union, you own a kind of a bond. CD’s are quite a bit different than other kinds of bonds, but they have many things in common.

Bonds are one of the easiest and most common ways to save money for the long term. There’s a good chance you already own one. If you have a certificate of deposit at your bank or your credit union, you own a kind of a bond. CD’s are quite a bit different than other kinds of bonds, but they have many things in common. You may have seen an article or heard someone at your bank talk about putting some money in a CD ladder. This arrangement helps you take advantage of changes in interest rates over time. It’s another way to attempt to deal with inflation issues as well.

You may have seen an article or heard someone at your bank talk about putting some money in a CD ladder. This arrangement helps you take advantage of changes in interest rates over time. It’s another way to attempt to deal with inflation issues as well.